THE Forest Council says it will support a rise in Council Tax payments on empty and second homes to increase the number of properties available for local people.

Councils across the country are supporting measures to address empty properties through the reduction in time after which a premium can be charged, from two years to one year.

The Levelling Up and Regeneration Bill, published by the Government in 2022, would also allow councils to introduce a Council Tax premium of up to 100 per cent on second homes.

The legislation has not yet been passed by the Government, but councils are supporting the measures in principle to allow them to be applied once passed.

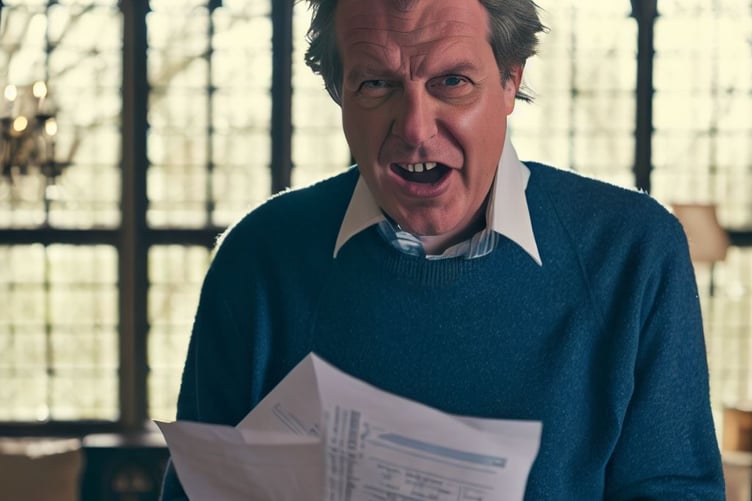

Cabinet Member for Finance, Cllr Andy Moore said: “We are supporting this new Government legislation with the intention of making more homes available to local people.

“The rise in the cost of housing in the Forest has made it very difficult for local people to buy homes. There are currently over 300 second homes across the Forest and we believe that this legislation will help to bring that number down.

“We hope that the legislation will lead to more homes being available for our residents and we will adopt this legislation once it has passed through Government.

“The additional income brought into the council from the empty and second homes will also help us to continue to support local services for residents at a time when Government funding is reducing.”

The premium for second homes can only be implemented with the Council giving at least one-year’s notice to council tax payers.

Therefore, the Council would need to make a decision before 01 April 2024, for this to take effect from April 2025. Should the legislation not be passed as intended, the premium will not be introduced.

.png?width=209&height=140&crop=209:145,smart&quality=75)

Comments

This article has no comments yet. Be the first to leave a comment.